Account security can’t be emphasized enough. It probably seems like we talk about it a lot, and that’s because we do.

At Avadian, we do a lot of things behind the scenes on your behalf to keep your accounts safe. Today in this space, we want to talk about account alerts, online activity alerts, security alerts, and transaction alerts – alerts you can set up to be sent to you if certain conditions are met.

(To read about how you can protect yourself from phishing scams, click here.)

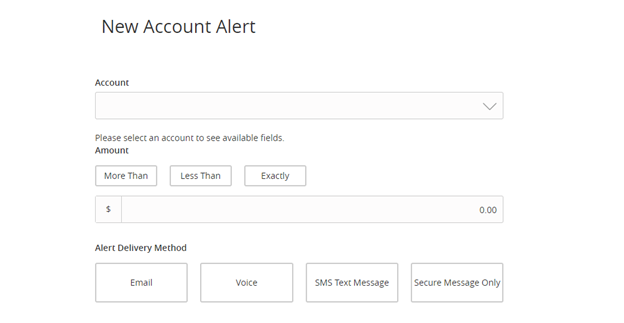

Account alerts are used to notify you about your account balance. You can set them to notify you when your balance (1) is exactly, (2) drops below, or (3) rises above your selected threshold.

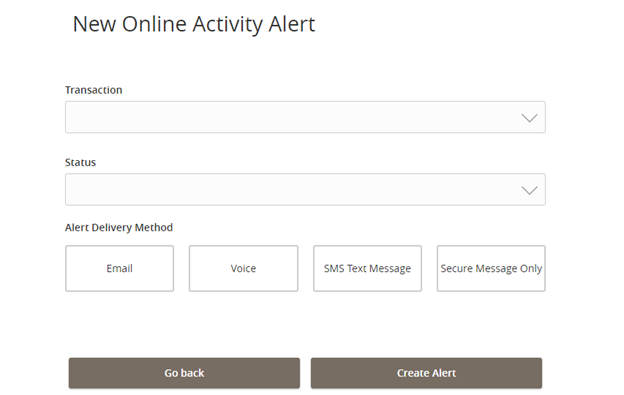

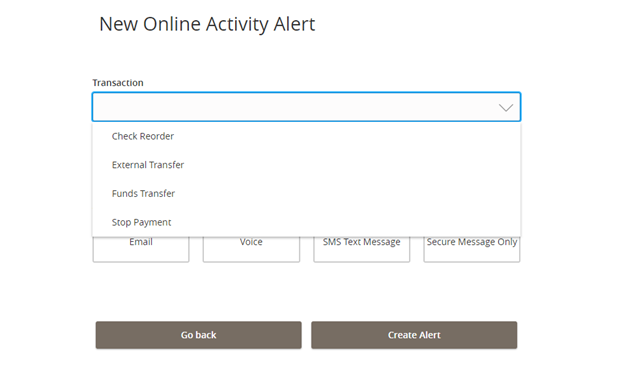

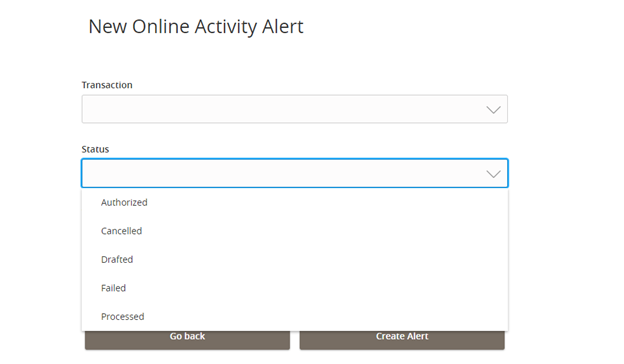

Online activity alerts are used to notify you about the status of a check reorder, external transfer, funds transfer, or stop payment.

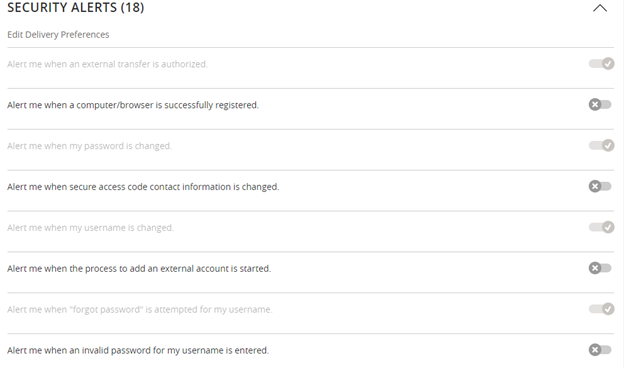

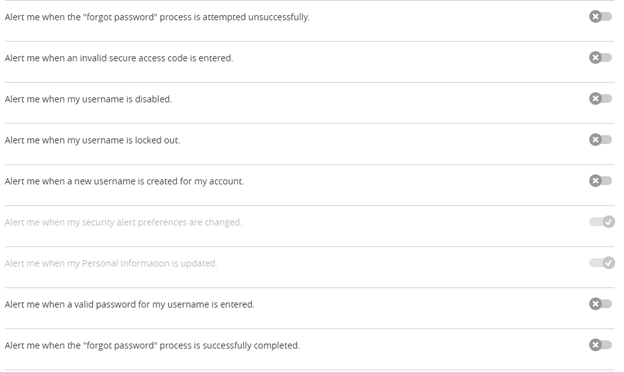

Security alerts are used to notify you about actions that might affect the security of your account such as password changes, external transfers, and more.

Security alerts are used to notify you about actions that might affect the security of your account such as password changes, external transfers, and more.

The alerts in faint text are required and cannot be turned off. The other alerts can be toggled off and on as you choose.

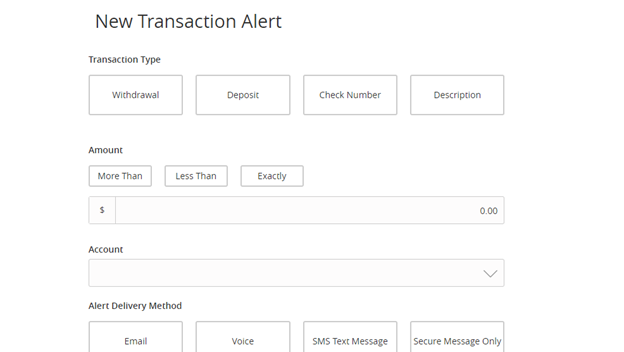

Transaction alerts are used to notify you when a debit or credit transaction is more than, less than, or an exact amount you specify. They can also be used to notify you when a specific check number posts or when a transaction description matches text that you specify.

We encourage you to make full use of the alerts our online banking offers and to be vigilant against other identity threats like phishing.